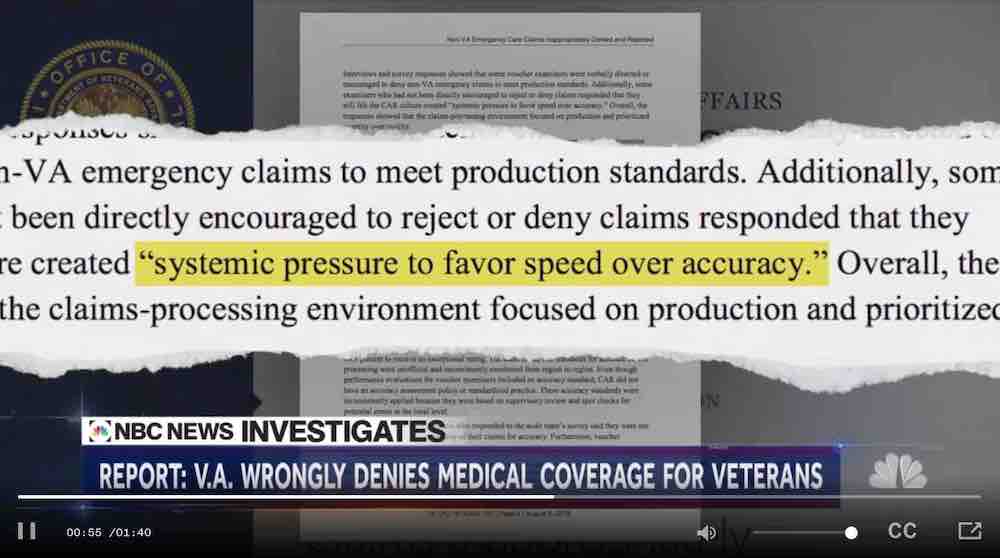

Fundamentally, the VA’s action decouples the collection of medical bills from coercive credit reporting.

#Va copay in emgency room free#

Veterans entitled to free medical care from the VA will not find medical bills for that care on their credit reports. After this change by the VA, unpaid bills of less than $25 will not be reported to consumer reporting companies meaning, they won’t drag down veterans’ credit scores. The VA has determined the individual responsible is not catastrophically disabled or entitled to free medical care from the VA, andĪs a result of the VA’s action, veterans who incur medical bills with the VA no longer need to fear that those medical bills will hurt their credit in most circumstances.The VA has exhausted all other debt collection efforts,.Under its new rule, the VA will only report medical debt that meets all of the following standards: Changes to VA’s debt collection practices

Coupled with the other announced changes by the VA, which provide additional protections to the most financially vulnerable veterans, these changes will result in a 99% reduction of unfavorable debt that it reports to consumer reporting companies. Under the VA’s new rule, the agency will only report a medical bill after all other collection efforts have been exhausted, largely eliminating coercive credit reporting as a debt collection technique.

The Department of Veterans Affairs (VA) took a major step towards protecting veterans and their families by announcing a change to when it will report information on outstanding medical bills to consumer reporting companies. On top of the initial medical crisis, this financial distress can make it even harder for a family to recover. Aggressive debt collection and coercive credit reporting can make matters worse by pressuring families to pay medical bills.

Getting sick or injured can often result in a heavy financial burden for many families, leaving them with mounting medical bills.

0 kommentar(er)

0 kommentar(er)